고정 헤더 영역

상세 컨텐츠

본문

Section 1 – Support/Resistance Indicators. Extreme Lines.

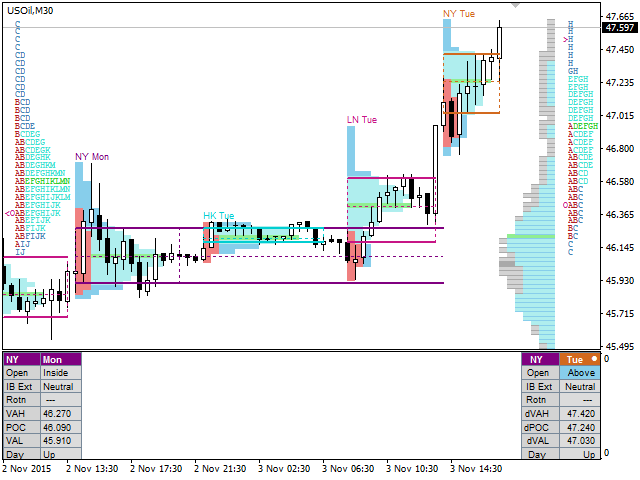

Profile IndicatorsWhat are TFiA Extreme Lines Indicators?TFiA Extreme Lines are dynamic support and resistance levels.In the above screenshot, the lines adjust to predict turning points.All the arrows in green were using a 10-tick stop. If a trader had a first target trade of 5-ticks, the stop wouldn’t have been hit.What are Gomi Market Profile Indicators?They are a histogram of volume traded at every price.Imagine a histogram showing the height of children in a school class. It would show a bell-shaped distribution of the children’s height from a minimum of (say) 3 feet to maximum (say) 7 feet.Traders with Profile software will know to buy at ‘3 feet’ and sell at ‘7 feet’. Our software shows the pending buyers in green and the sellers in red. The indicator shows the areas of distribution using a ‘heat map’. In the low distribution areas, which are blue, we look for reversals.Point Of Control.In the above screenshot, The Point of Control is shown on the Profile as red lines.The Point of Control is the bar with the highest volume of contracts traded. If traders are below the bar they look for shorts and if above, they look for longs.The value area is shown in blue lines and is where the highest volume of trades has occurred and are like support/resistance areas on the first touch.The green line is the VWAP – volume weighted average price.

The line at 37.54 acts as both support and resistance.The above screenshot shows a histogram of order volume. In mathematics it is known as the probability distribution function. It shows high volume nodes – the high peaks of distribution. The suction tubes (the long blue area), is where the market will move through quickly, looking for “support or resistance”. TFiA will teach members how to trade these areas. Section 1 – Support/Resistance Indicators.

Extreme Lines. Profile IndicatorsWhat are TFiA Extreme Lines Indicators?TFiA Extreme Lines are dynamic support and resistance levels.In the above screenshot, the lines adjust to predict turning points.All the arrows in green were using a 10-tick stop. If a trader had a first target trade of 5-ticks, the stop wouldn’t have been hit.What are Gomi Market Profile Indicators?They are a histogram of volume traded at every price.Imagine a histogram showing the height of children in a school class. It would show a bell-shaped distribution of the children’s height from a minimum of (say) 3 feet to maximum (say) 7 feet.Traders with Profile software will know to buy at ‘3 feet’ and sell at ‘7 feet’.

Our software shows the pending buyers in green and the sellers in red. The indicator shows the areas of distribution using a ‘heat map’. In the low distribution areas, which are blue, we look for reversals.Point Of Control.In the above screenshot, The Point of Control is shown on the Profile as red lines.The Point of Control is the bar with the highest volume of contracts traded.

If traders are below the bar they look for shorts and if above, they look for longs.The value area is shown in blue lines and is where the highest volume of trades has occurred and are like support/resistance areas on the first touch.The green line is the VWAP – volume weighted average price. The line at 37.54 acts as both support and resistance.The above screenshot shows a histogram of order volume. In mathematics it is known as the probability distribution function. It shows high volume nodes – the high peaks of distribution. The suction tubes (the long blue area), is where the market will move through quickly, looking for “support or resistance”. TFiA will teach members how to trade these areas. Government Required Disclaimer – Futures, Options, and Forex trading has large potential rewards, but also large potential risk.

You must be aware of the risks and be willing to accept them in order to invest in the futures, options, and Forex markets. Don’t trade with money you can’t afford to lose.

This is neither a solicitation nor an offer to Buy/Sell futures, options, or Forex contracts. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site/ educational room. The past performance of any trading system or methodology is not necessarily indicative of futures result. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

How to set up Fin-Alg Market Profile Charts in NinjaTraderFinancial Algorithm is known for its Final Market Balance and the TPO ( Market Profile ) and Volume Profile Indicator package for NinjaTrader. This package is an economical alternative to get Market Profile charts as is a free platform and the cost of Fin-Alg TPO Profile and Volume profile package is much more affordable compared to other expensive packages. Though it’s a personal choice of selecting the Software but those who find it difficult to make a choice, we have made an effort to review the Pros & Cons of Fin-Alg Market Profile Indicator package below. Commitment by Clients on the options front is still heavy PUT shorts while PROs do not have much commtment in optio. 26-07-19 After booking out most of the CE shorts in Expiry & minting for the entire expiry, PROs now hold 10% +ve I. 24-07-19 Clients liquidated few longs in Index fut & did short covering in PUT shorts.

FIIs did some short covering. 23-07-19 Clients went long as usual in the dip & PROs & FIIs combined milked the move by selling generously to the. 22-07-19 Clients went long as usual in the dip & PROs & FIIs combined milked the move by selling generously to the. Futures trading involves substantial risk of loss and not suitable for all investors. An investor could potentially lose all or more than the initial investment.

Gomi Market Profile Indicators

Past performance is not necessarily indicative of future results. All trades, patterns, charts, systems, etc., discussed in this website or advertisement are for illustrative purposes only.CTFC RULE 4.41Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.